Brazil Hydrogen Fuel Cell Vehicle Market Trends, Analysis & Outlook 2033

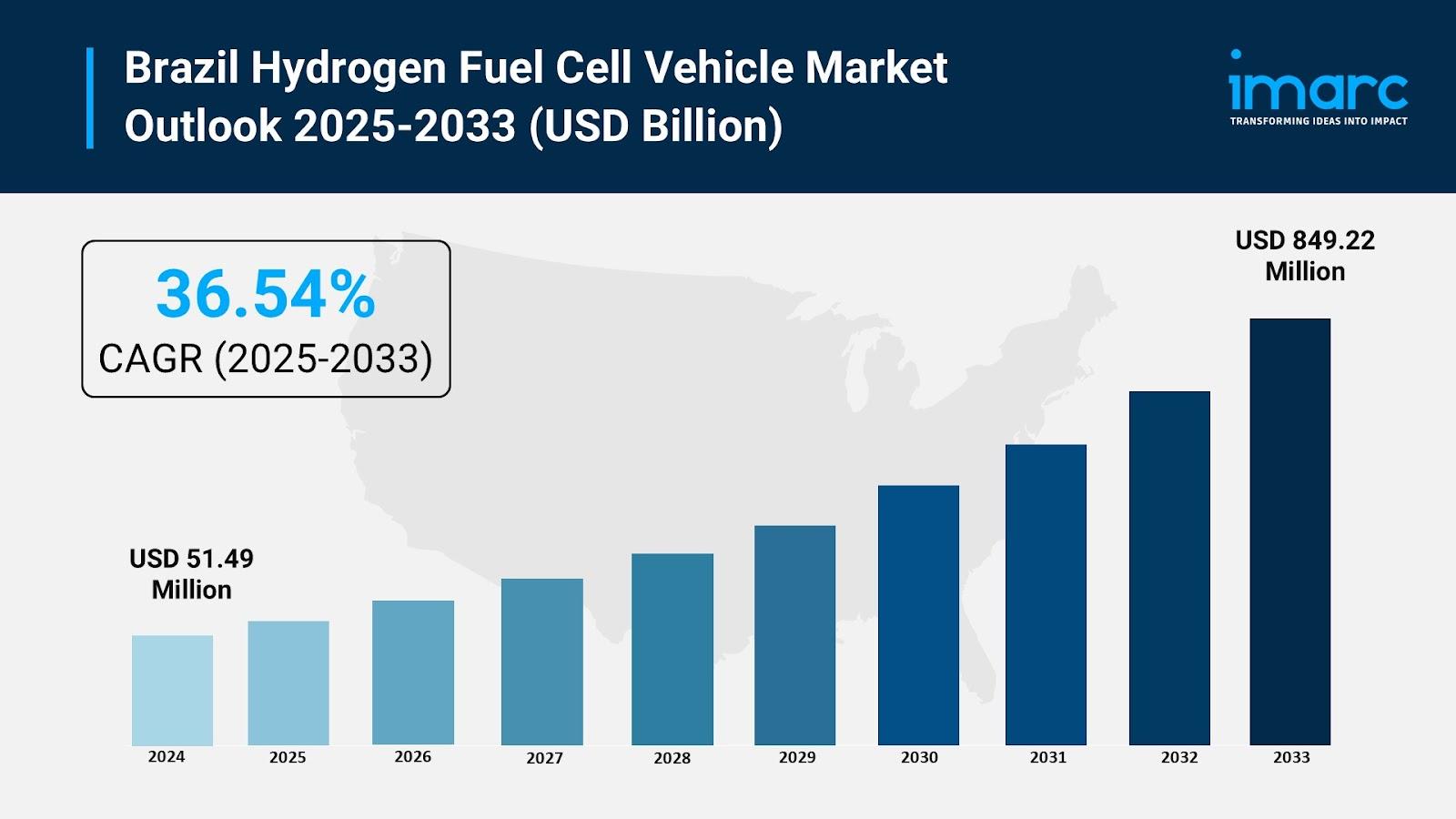

The Brazil Hydrogen Fuel Cell Vehicle Market reached USD 51.49 Million in 2024 and is expected to grow to USD 849.22 Million by 2033, exhibiting a strong CAGR of 36.54% during 2025–2033. Growth is driven by government policy support, ethanol-based hydrogen production innovation, and strategic international partnerships enabling technology transfer. Market expansion is centered on transportation decarbonization, renewable energy integration, and hydrogen ecosystem development across Brazil.

Study Assumption Years

- Base Year: 2024

- Historical Period: 2019–2024

- Forecast Period: 2025–2033

Brazil Hydrogen Fuel Cell Vehicle Market Key Takeaways

- Market Size (2024): USD 51.49 Million, projected to reach USD 849.22 Million by 2033.

- CAGR (2025–2033): 36.54%.

- Government policies such as the Low-Carbon Hydrogen Law and tax incentives support clean energy initiatives.

- Ethanol-to-hydrogen technology leverages Brazil’s sugarcane industry to supply hydrogen for vehicles like Toyota Mirai and Hyundai Nexo.

- Strategic partnerships with Great Wall Motor, Toyota, and Hyundai enhance technology transfer and hydrogen infrastructure development.

- Brazil is developing 12 low-carbon hydrogen hubs and multiple refueling stations to expand its hydrogen ecosystem.

Sample Request Link:-

https://www.imarcgroup.com/brazil-hydrogen-fuel-cell-vehicle-market/requestsample

The Brazil hydrogen fuel cell vehicle market is strongly supported by a comprehensive policy framework. The Low-Carbon Hydrogen Law enacted in August 2024 established the National Low-Carbon Hydrogen Policy and introduced the Special Incentive Regime for Low-Carbon Hydrogen Production (Rehidro). Starting January 2025, federal tax suspensions on hydrogen-related machinery and equipment reduce financial constraints, especially for heavy-duty commercial vehicles seeking emissions reduction through hydrogen fuel cell adoption.

Infrastructure advancements significantly boost market development. Leveraging Brazil’s extensive sugarcane ethanol sector, the country has pioneered ethanol-based hydrogen production. An example is the University of São Paulo’s hydrogen plant launched in February 2025. This R$50 million pilot facility produces 100 kg of hydrogen daily with 99.999% purity through ethanol steam reforming, a carbon-negative process. Integration with existing ethanol logistics allows rapid cost-effective scale-up, supplying hydrogen to campus buses and fuel cell vehicles from Toyota and Hyundai.

International collaboration accelerates market progress. In August 2025, Great Wall Motor inaugurated a manufacturing facility in São Paulo and launched Brazil’s first hydrogen fuel cell heavy-duty truck utilizing advanced GWM HYDROGEN-FTXT systems. The initiative includes hydrogen refueling station development, technology exchange programs, and university partnerships. Toyota and Hyundai complement these efforts by providing vehicles for testing and contributing to ecosystem development. These collaborations enhance innovation and fast-track hydrogen mobility across Brazil.

Technology Insights

- Proton Exchange Membrane Fuel Cell

- Phosphoric Acid Fuel Cell

- Others

Vehicle Type Insights

- Passenger Vehicle

- Commercial Vehicle

Regional Insights

Brazil’s hydrogen vehicle market spans Southeast, South, Northeast, North, and Central-West regions. While specific regional market shares or CAGRs are not detailed, all five regions are included in long-term forecasts and infrastructure development assessments from 2025 to 2033.

Recent Developments & News

- August 2025: Great Wall Motor opened its Iracemápolis facility and launched Brazil’s first hydrogen fuel cell heavy-duty truck. Road trials were initiated with universities, testing performance with both green and ethanol-derived hydrogen. The initiative supports Brazil’s MOVER Program and includes the development of five hydrogen refueling stations in São Paulo.

- January 2025: Brazil’s Ministry of Mines and Energy approved 12 low-carbon hydrogen hub projects involving CSN Group, EDP Renováveis Brasil, and Petrobras. The projects leverage government incentives to decarbonize heavy industries such as petrochemicals, cement, and steel.

Key Players

- CSN Group

- EDP Renováveis Brasil

- Petrobras

- Great Wall Motor

- Shell Brasil

- Raízen

- Toyota

- Hyundai

If additional details or specific insights are needed, they can be provided as part of the customization.

IMARC Group is a global consulting firm offering market assessment, feasibility studies, company incorporation support, factory setup guidance, regulatory approvals, marketing strategies, competitive analysis, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

India: +91 120 433 0800

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness