Brazil Frozen Lamb Market Analysis: Key Trends, Drivers & Outlook 2025–2033

Market Overview

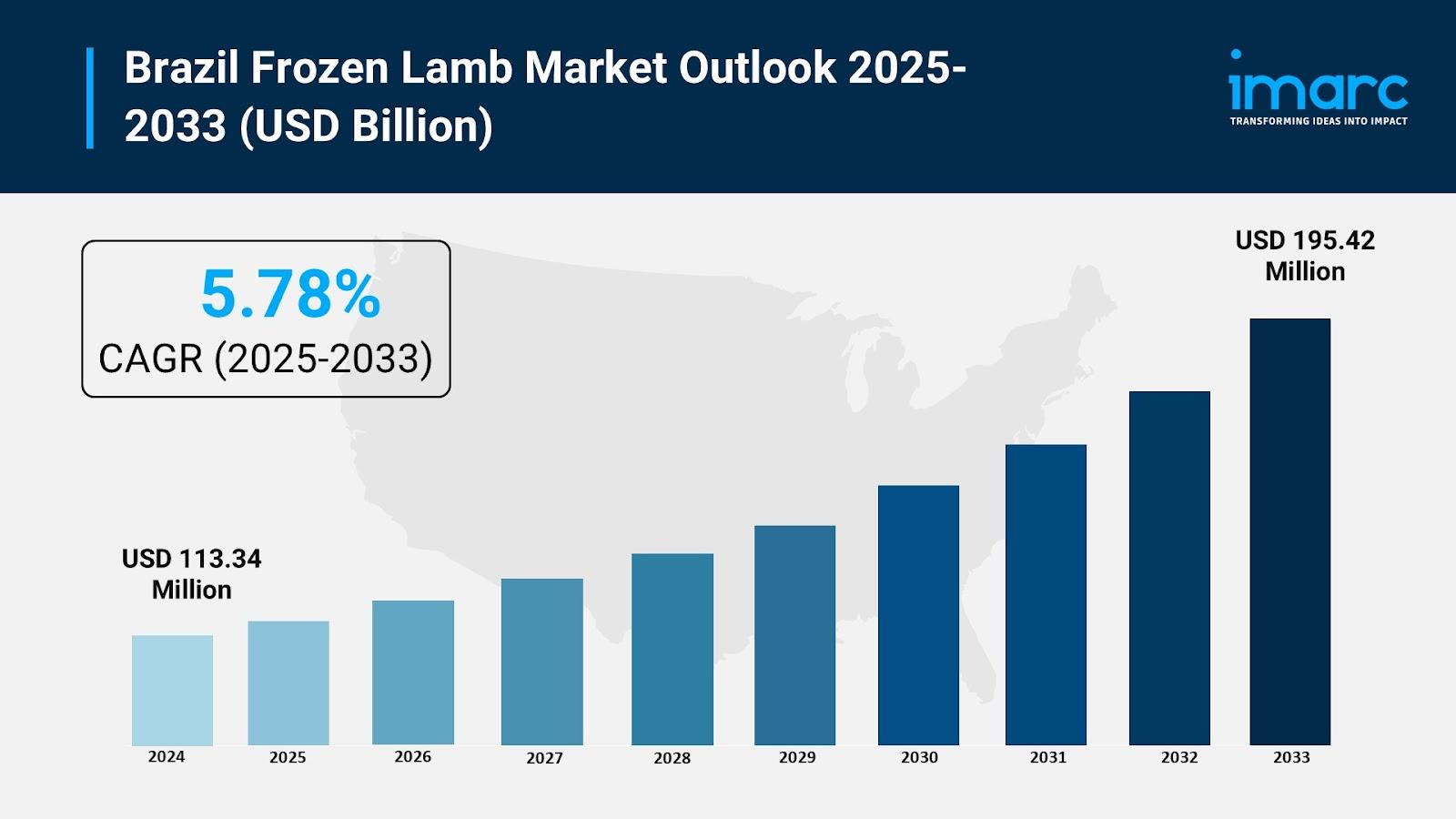

The Brazil frozen lamb market reached USD 113.34 Million in 2024 and is projected to grow to USD 195.42 Million by 2033, exhibiting a CAGR of 5.78% during 2025-2033. Market expansion is driven by evolving consumer preferences for diverse protein options, rising export volumes, improvements in cold chain logistics, and increasing demand for premium and halal-certified meat products.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Brazil Frozen Lamb Market Key Takeaways

- 2024 Market Size: USD 113.34 Million

- CAGR (2025-2033): 5.78%

- Forecast Outlook: Market set to reach USD 195.42 Million by 2033

- Brazilian consumers increasingly shifting toward diverse and nutrient-rich protein sources such as lamb.

- Brazil exported USD 57.44K worth of frozen lamb in 2023, primarily to the Marshall Islands, Thailand, and Greece.

- Improvements in cold chain systems and transportation infrastructure enhance product availability and maintain quality.

- Rising demand for halal-certified frozen lamb from Muslim-majority nations strengthens export opportunities.

Sample Request Link: https://www.imarcgroup.com/Brazil-Frozen-Lamb-Market/requestsample

Market Growth Factors

Evolving Consumer Preferences Fueling Domestic Demand

The market benefits from a noticeable shift towards nutritious and protein-rich foods. Lamb consumption is rising among health-conscious consumers and gourmet food enthusiasts. Notably, 73.3% of higher-income men prefer lamb meat, prompting retailers to expand their frozen lamb assortments. This trend strengthens domestic demand and supports the steady growth of Brazil’s frozen lamb industry.

Strong Export Performance Supporting Market Expansion

Brazil remains a key global meat exporter, with frozen lamb exports reaching USD 57.44K in 2023. Shipments to the Middle East, Europe, and Asia highlight increasing global trust in Brazilian lamb products. Government promotion of halal certification opens doors for exports to Muslim-majority countries where halal-certified lamb is in high demand.

Advancements in Cold Chain and Logistics Infrastructure

Improved logistics systems significantly strengthen market expansion. Brazil’s cold storage capacity exceeds 15 million cubic meters, with major players like GCCA handling over 55% of the total capacity. Enhanced road networks, cold storage facilities, and technology-enabled logistics systems ensure freshness, reduce wastage, and improve overall distribution efficiency—supporting nationwide availability.

Market Segmentation

Type Insights:

- Lamb Head: Frozen lamb head products used for various culinary and cultural preferences.

- Lamb Rack: Premium frozen rack cuts catering to high-end consumers and restaurants.

- Lamb Leg: Popular frozen lamb cut used widely for domestic and commercial cooking.

- Others: Additional frozen lamb product categories.

Distribution Channel Insights:

- Supermarkets/Hypermarkets: Primary distribution channel offering wide frozen lamb selections.

- Departmental Stores: Specialty retail channels supplying selective frozen lamb products.

- B2B: Supplies to food service providers, hotels, and institutional buyers.

- Online Sales Channel: E-commerce platforms expanding access nationwide.

Regional Insights

Major regional markets include Southeast, South, Northeast, North, and Central-West. The Southeast and South regions dominate due to higher lamb consumption rates, strong retail presence, and established cold-chain networks. Specific market shares and CAGR by region are not provided in the source but collectively contribute significantly to national market dynamics.

Recent Developments & News

- October 2023: JBS announced a R$ 15 billion (approx. USD 3 billion) investment plan to expand operations in Brazil by 2026.

- 2023: Archer Daniels Midland increased capacity across three Brazilian facilities, adding 400,000 metric tons annually.

- August 2023: Minerva Foods acquired Marfrig’s slaughtering and deboning operations for R$ 7.5 billion (USD 1.54 billion), boosting its revenue projection by 45%.

Key Players

- JBS

- Archer Daniels Midland

- Minerva Foods

Request Customization: https://www.imarcgroup.com/request?type=report&id=29081&flag=E

If you require any specific information not covered within the scope of the report, we will provide it as part of the customization.

About Us

IMARC Group is a global management consulting firm that assists organizations in achieving strategic growth. Our services include market assessment, feasibility studies, company setup, regulatory guidance, branding strategies, competitive benchmarking, pricing research, and procurement advisory.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No. (D): +91 120 433 0800

United States: +1-201-971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Giochi

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Altre informazioni

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness