Brazil Bancassurance Market Trends & Forecast 2025–2033

Market Overview

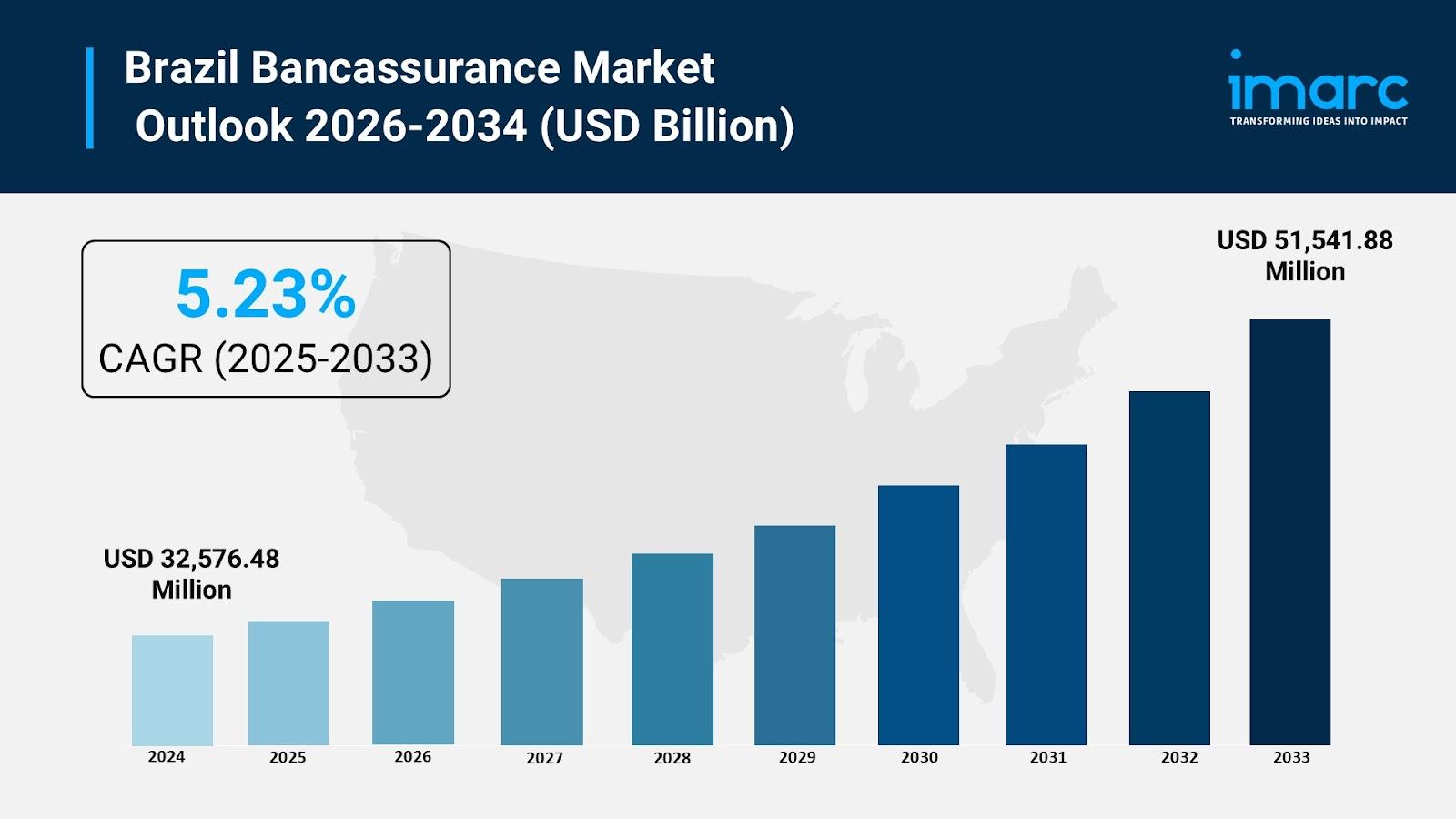

The Brazil Bancassurance Market reached a size of USD 32,576.48 Million in 2024 and is projected to grow steadily at a CAGR of 5.23% during 2025–2033, reaching USD 51,541.88 Million by 2033. This growth is driven by dominant bank-owned insurance groups leveraging extensive branch networks and captive insurers to scale cross-selling, along with rapid digitalization and partnerships with fintechs lowering distribution costs.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019–2024

- Forecast Period: 2025–2033

Brazil Bancassurance Market Key Takeaways

- Current Market Size: USD 32,576.48 Million in 2024

- CAGR: 5.23%

- Forecast Period: 2025–2033

- Large banking groups such as Bradesco, Itaú Unibanco, and Caixa Econômica Federal operate fully integrated insurance models combining branch networks, captive insurers, and shared customer databases for efficient cross-selling.

- Digitalization and open finance frameworks drive cost reduction and innovation in product offerings, including microinsurance and personalized mobile policies.

- Brazilian insurers recorded BRL 207.6 Billion in revenues in 2024, up 10.2% from 2023, led by Life and Property insurance lines.

- Partnerships with fintechs, digital brokers, and correspondent banking channels extend bancassurance reach into remote and informal markets.

- Data analytics enable dynamic pricing and personalized rider bundling, improving conversion and retention.

Sample Request Link: https://www.imarcgroup.com/brazil-bancassurance-market/requestsample

Market Growth Factors

At present, several of Brazil's largest banking conglomerates have vertically integrated bancassurance models utilizing their broad branch networks, captive insurers, and customer databases, notably Bradesco, Itaú Unibanco, and Caixa Econômica Federal. The models create streamlined cross-selling environments at banks, which manage product development, pricing, and claims directly. Corporate bancassurance channels are integrated into banking product contracts. The usage of payroll or account debits for premiums and claims allows for better management. In 2024, Brazilian insurance revenues reached BRL 207.6 billion (10.2% increase compared to 2023). Combined, Life and Property insurance accounted for 67% of this increase. The more stable revenues from insurance support greater diversification of portfolios and reduce banking groups' dependence on interest rate spreads.

Digital transformation and open banking regulations have transformed product distribution and pricing for bancassurance in Brazil. Banks and insurers leverage ecosystems of APIs, machine learning, and recommendation engines to personalize products in mobile and internet banking. In 2024, Brazilian reinsurance behemoth IRB's net income jumped to R$372.7 Million (+226.2% YoY), while its combined ratio decreased to 101.2%. Instant e-underwriting and e-signatures allow for near-real-time issuance of term, travel and microinsurance policies to better serve digitally native and underbanked consumers. Partnerships with fintechs and digital brokers entail embedding bancassurance into super-apps and e-commerce platforms. Microinsurance with low premiums and flexible pay-as-you-go models attracts first-time purchasers and encourages repeat purchases. Microinsurance also improves penetration and economic efficiency.

Advanced data analytics can enable dynamic pricing, contextual experience and personalized rider bundling, leading to better conversion rate and customer retention in the bancassurance model with various segmentation strategies that serve both the mass and premium markets. Analytics and AI support data-driven underwriting and marketing decisions to maximize the customer lifetime value. Distribution costs are reduced by leveraging digital and correspondent channels to expand and improve bancassurance economics. In the dynamic financial services landscape in Brazil, these innovations help to enable sustainable growth by expanding access and improving the customer experience.

Brazil Bancassurance Market Segmentation

Product Type Insights

- Life Bancassurance: Covers bancassurance products related to life insurance, facilitating integrated offerings through bank channels.

- Non-Life Bancassurance: Encompasses health, property, and other non-life insurance products sold via bancassurance frameworks.

Model Type Insights

- Pure Distributor: Banks act solely as distributors of insurance products without equity ownership.

- Exclusive Partnership: Banks and insurers collaborate exclusively for distribution.

- Financial Holding: Banks hold equity stakes in insurers, enabling integrated operations.

- Joint Venture: Shared ownership and operational control between banks and insurance companies.

Regional Insights

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast region dominates the Brazilian bancassurance market, supported by high banking penetration and mature insurance infrastructure. Other regions—South, Northeast, North, and Central-West—are experiencing gradual expansion driven by microinsurance and digital banking inclusion.

Recent Developments & News

- In July 2024, CNP Seguradora entered a 20-year exclusive distribution agreement with Banco de Brasília, expanding access to 7.8 million customers for consórcio and capitalização products. This marks a significant expansion of bancassurance distribution capacity in Brazil.

Competitive Landscape

The competitive landscape includes profiles of key bancassurance players in Brazil, such as Bradesco Seguros, Itaú Seguros, Caixa Seguradora, CNP Seguradora, and Porto Seguro, among others. These players are focusing on product innovation, digital integration, and long-term distribution partnerships to enhance market reach and customer engagement.

Request Customization: https://www.imarcgroup.com/request?type=report&id=42050&flag=E

About Us

IMARC Group is a global management consulting firm assisting the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, incorporation support, factory setup, regulatory navigation, branding and marketing strategy, competitive benchmarking, and procurement research.

Contact Us

IMARC Group

134 N 4th St, Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel (India): +91 120 433 0800

Tel (U.S.): +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- الألعاب

- Gardening

- Health

- الرئيسية

- Literature

- Music

- Networking

- أخرى

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness