Executive Review of the Insurance Software Market 2025–2033 Mapping Automation Trends and Core System Modernization

Market Overview

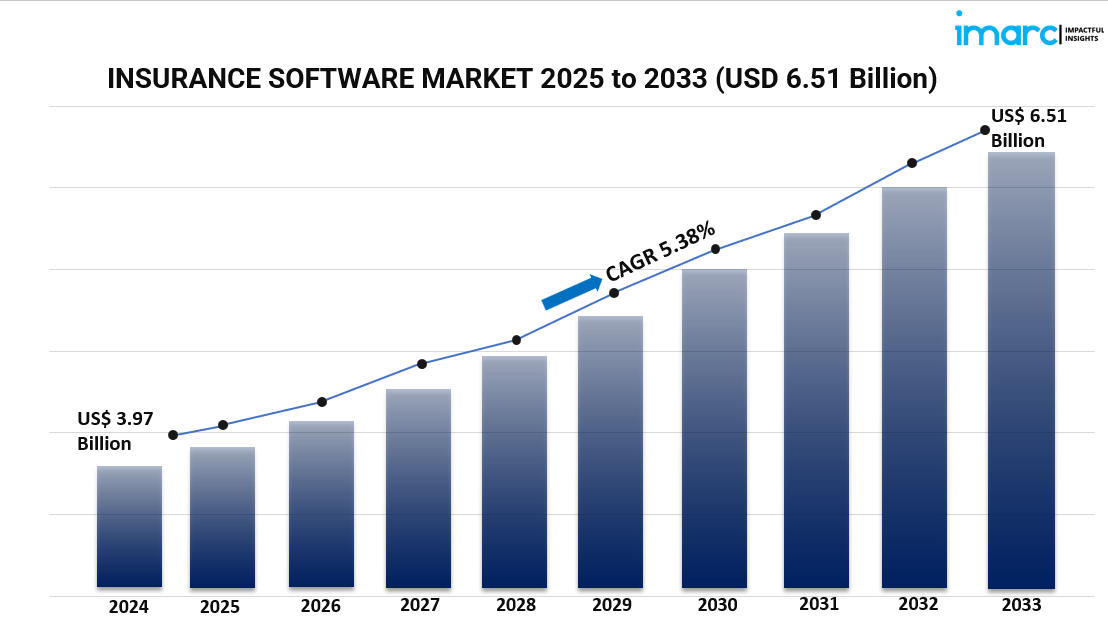

The global insurance software market was valued at USD 3.97 Billion in 2024 and is projected to reach USD 6.51 Billion by 2033, growing at a CAGR of 5.38% during 2025-2033. Driven by automation needs, mobile app demand, AI integration, and regulatory compliance, the market demands scalable, flexible software solutions that enhance operational efficiency and customer experience. For further information, visit the Insurance Software Market

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Insurance Software Market Key Takeaways

- The global insurance software market size was valued at USD 3.97 Billion in 2024.

- The market is expected to grow at a CAGR of 5.38% during 2025-2033.

- The forecast period for the market extends from 2025 to 2033.

- North America dominated the market in 2024 with a 38.8% market share.

- Insurers are adopting AI, cloud platforms, and automation to improve efficiency and compliance.

- The U.S. accounts for 86.6% of North America’s market share, driven by digital transformation.

- The Asia Pacific region sees growth due to rising smartphone penetration and scalable cloud solutions.

Sample Request Link: https://www.imarcgroup.com/insurance-software-market/requestsample

Market Growth Factors

The global insurance software market is expanding primarily due to insurers' need to modernize outdated systems and automate processes. Automation and cloud-based platforms reduce manual workflows, streamline claims processing, and lower operational costs while ensuring regulatory compliance amid evolving rules. Cybersecurity features have also become critical due to rising data security concerns.

Customer preferences are shifting towards digital, self-service portals and mobile apps, prompting insurers to invest in AI and analytics for personalized offerings, fraud detection, and optimized underwriting. Partnerships with insurtech firms foster agility and innovation in software solutions, driving market growth.

In regions like the U.S., SaaS-based insurance software adoption through cloud marketplaces simplifies procurement and deployment, enabling faster onboarding, updates, and integration. This supports operational efficiency and scalability, especially for cloud-native tools without complex infrastructure needs, further propelling insurance software demand.

Market Segmentation

Analysis by Type:

- Life Insurance: Part of the market segmentation.

- Accident and Health Insurance: Largest type in 2024, driven by demand for digital tools that simplify claims, underwriting, and policy management, amid rising healthcare costs.

- Property and Casualty Insurance: Included in segmentation.

- Others: Covered but no specific details provided.

Analysis by Deployment Mode:

- Cloud-based: Adoption increasing, especially in the U.S. via cloud marketplaces.

- On-premises: Led the market in 2024 owing to insurers' preferences for control, security, customization, and compliance with regulatory standards.

Analysis by End User:

- Brokers: Included.

- Agencies: Part of the segmentation.

- Insurance Companies: Led the market in 2024 with approximately 63.6% share, driven by the need to improve efficiency, reduce costs, and enhance customer experience through advanced software.

Regional Insights

North America dominated the insurance software market in 2024, holding a 38.8% share due to advanced technological infrastructure, early adoption of digital innovation, and a mature insurance industry. The U.S. specifically accounted for 86.6% of North America’s share, driven by digital transformation, regulatory demands, and increased adoption of cloud-based and AI-powered software solutions.

Recent Developments & News

- In June 2025, InsureMO launched Agentic AI, an AI-driven platform enhancing insurance operations with intelligent automation and conversational analytics.

- In May 2025, INTX Insurance Software expanded into North America, providing scalable end-to-end P&C policy administration technology.

- In April 2025, Sapiens International Corporation acquired Candela to diversify offerings and expand its Asia Pacific presence.

Key Players

- Accenture Plc

- Acturis Ltd.

- Axxis Systems SA

- Buckhill Ltd.

- EIS Software Limited

- Guidewire Software Inc.

- Mitchell International Inc.

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- Sapiens International Corporation

- Solartis Technology Services Pvt Ltd.

- Vertafore Inc (Roper Technologies Inc.)

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for customization: https://www.imarcgroup.com/request?type=report&id=6747&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Oyunlar

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness