Turkey Consumer Credit Market Size, Share, Trends and Report 2025-2033

Market Overview

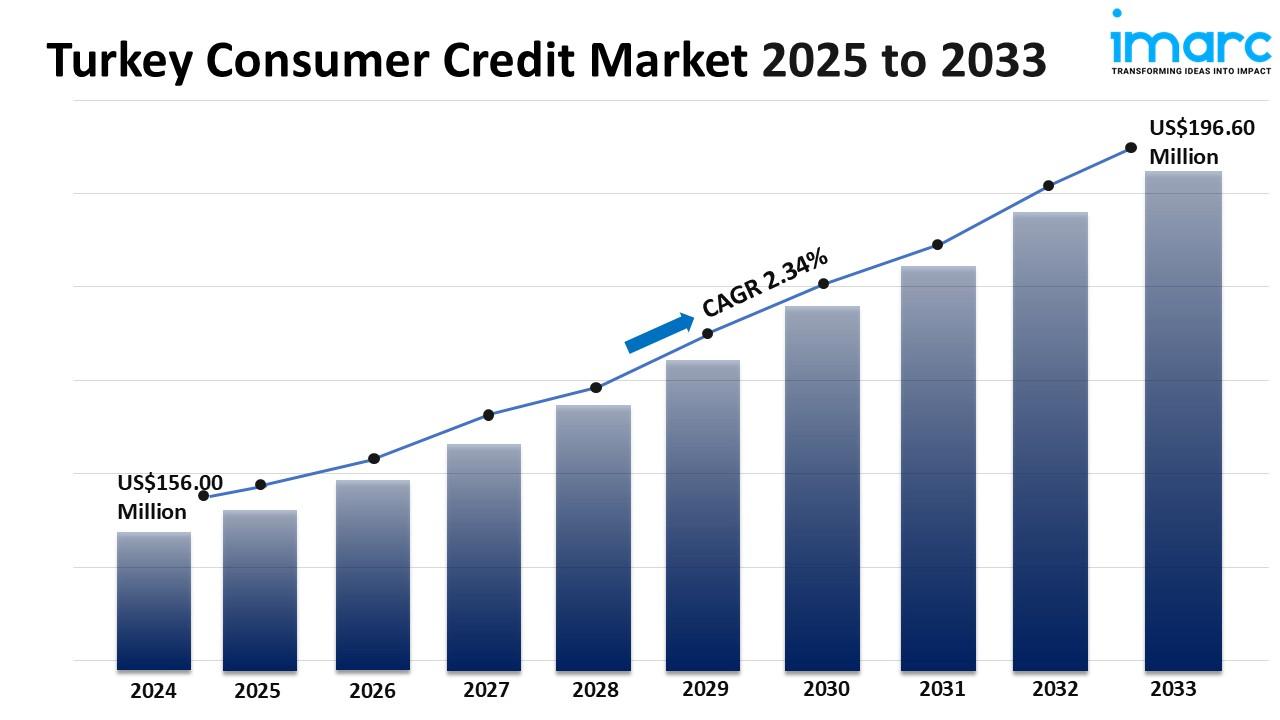

The Turkey consumer credit market was valued at USD 156.00 Million in 2024 and is projected to reach USD 196.60 Million by 2033. The market is expected to grow at a CAGR of 2.34% during the forecast period of 2025-2033. Growth is driven by technological innovations such as biometric credit cards and increased regulatory scrutiny, which enhance security and convenience while promoting a competitive landscape. These developments strengthen the market share, benefiting consumers and financial institutions alike.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Turkey Consumer Credit Market Key Takeaways

- The market size reached USD 156.00 Million in 2024.

- The market is expected to grow at a CAGR of 2.34% from 2025 to 2033.

- The forecast period for the market is 2025-2033.

- Technological advancements like biometric credit cards have transformed the market by offering enhanced security and convenience.

- Regulatory efforts, including investigations by the Turkish Competition Authority, aim to ensure fair competition and consumer protection.

- The increasing use of biometric cards has significantly improved transaction security and user experience.

- Market segmentation includes credit type, service type, issuer, and payment methods, highlighting diverse consumer credit options.

Sample Request Link: https://www.imarcgroup.com/turkey-consumer-credit-market/requestsample

Market Growth Factors

The growth of the Turkey consumer credit market is propelled by technological innovations that enhance payment security and convenience. For instance, in May 2024, Garanti BBVA launched the country's first biometric credit card, combining contactless payments with fingerprint verification. This innovation significantly improved transaction security and speed while eliminating the need for PIN inputs. The instant market popularity of the biometric credit card indicates strong consumer demand for sophisticated and secure payment solutions, which is driving expansion in the consumer credit sector.

Regulatory oversight is another critical driver fostering market growth. The Turkish Competition Authority's investigation in July 2025 into potential anti-competitive practices by Mastercard and Visa reflects the increasing focus on fair market competition. These regulations are expected to push credit card providers to offer better terms, lower fees, and a broader range of services. This regulatory environment encourages more affordable and diverse credit options, enhancing consumer choice and stimulating market growth.

Consumer habits shifting towards less cash-intensive payment methods have increased the adoption of faster, technology-driven financial products and services. Turkish banks are focusing on leading-edge technologies to meet these expectations, resulting in the deployment of innovative solutions that cater to growing demand for enhanced payment security and speed. These technological and regulatory trends collectively strengthen the Turkey consumer credit market, ensuring safer transactions and a more competitive marketplace.

Market Segmentation

Credit Type Insights:

- Revolving Credits

- Non-revolving Credits

The market is divided into revolving credits and non-revolving credits, representing different modes of consumer credit facilities in Turkey.

Service Type Insights:

- Credit Services

- Software and IT Support Services

This segment covers credit services alongside software and IT support necessary to facilitate and manage consumer credit operations effectively.

Issuer Insights:

- Banks and Finance Companies

- Credit Unions

- Others

These categories include the various issuers providing consumer credit, ranging from traditional banks to other financial entities.

Payment Method Insights:

- Direct Deposit

- Debit Card

- Others

Payment methods for consumer credit transactions include direct deposits, debit cards, and other channels, reflecting the varied ways consumers access credit funds.

Regional Insights

The report analyzes dominant regional markets including Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia. However, specific market shares or growth rates for these regions were not provided. These regions collectively contribute to the comprehensive coverage of Turkey’s consumer credit market from 2025 to 2033.

Recent Developments & News

In May 2024, Garanti BBVA introduced Turkey’s first biometric credit card, revolutionizing consumer credit by combining contactless payments with fingerprint authentication for enhanced security and convenience. In July 2025, Trendyol, Baykar, Ant International, and ADQ entered into an agreement to explore a fintech venture aimed at providing accessible digital credit solutions, thereby advancing financial inclusion and supporting consumer credit growth in Turkey’s evolving digital economy.

Key Players

- Garanti BBVA

- Trendyol

- Baykar

- Ant International

- ADQ

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness